Last week, another scandalous and potentially corrupt string of federal activities popped up.

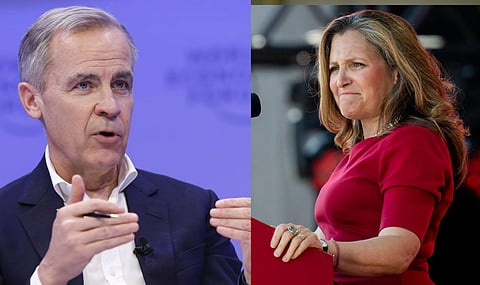

This one has deep implications for pension plans in Canada, including the debate about an Alberta Pension Plan. Mark Carney’s double game of politics and profit enhances the drive to patriate Alberta’s pension wealth.

At issue is a report in the media saying that Brookfield may be looking to raise a $50 billion fund with contributions from Canada's pension funds and an additional $10 billion from the federal government.

This report has drawn significant attention for several reasons. Toronto-based Brookfield is one of the world's largest alternative investment management companies, claiming about one trillion in assets under management. Their portfolio spans real estate, renewable energy, infrastructure, and private equity, making them a significant player in domestic and international markets. The magnitude of Brookfield's investments places them at the forefront of global financial movements, giving considerable weight to any fund they propose to establish.

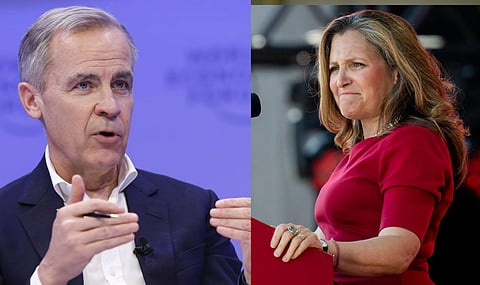

The second reason is that Finance Minister Chrystia Freeland and Prime Minister Justin Trudeau have voiced their ambitions to boost home-grown investments. One of the government's strategies includes tapping into Stephen Poloz, the former Governor of the Bank of Canada. Poloz succeeded Mark Carney as the head of the bank. The Liberal government has tasked Poloz with leading a working group to identify "incentives" that would “encourage” institutional investors to keep their capital in Canada.

Moreover, Finance Minister Freeland has suggested implementing new regulations to ensure that more of Canada's substantial pension fund reserves, which amount to an impressive $1.8 trillion, are allocated toward Canadian ventures. This comes when a staggering 73% of Canadian pension funds are invested abroad.

On its face, a plan to invest more Canadian wealth in Canada might sound reasonable. However, the plan avoids the crucial question of why money experts prefer investing outside Canada. Considering that question, one must consider the Trudeau government's economic record.

Put differently, Ottawa is looking for ways to compel large pools of Canadian money to be invested in Canada instead of allowing investment funds to find the best return for Canadian investors. Those large cash pools typically belong to hard-working Canadians, such as teachers' pensions. They would be forced to earn less for their pension money.

Forcing such large sums to remain in Canada would mask the continuous slump in productivity in the Canadian economy.

Given current economic policies and layers of taxation that do not exist elsewhere (such as the unpopular carbon taxes), Canadian companies are less competitive. Forcing pools of money to stay in Canada rather than seeking the best return for their clients offers an artificial boost that makes Ottawa policies seem less harmful.

It is, therefore, a politically motivated move. That level of government intervention historically always results in disastrous consequences. Politics directing traffic for the movement of capital rarely achieves good outcomes. The real issue is sagging productivity.

But that is only half the problem. The other significant issue is ethics.

Prime Minister Trudeau has recently named Mark Carney as his special economic advisor. Carney is the Chair of Asset Management and Head of Transition Investing at Brookfield. The Brookfield website shows Carney is responsible for “developing products for investors.” Carney is also the most mentioned name among people likely to succeed Justin Trudeau as leader of the Liberal Party of Canada.

In short, the man who closely advises the government of Canada on how to compel gargantuan pools of money to be invested in Canada conveniently oversees the development of the “product” for the private Toronto firm, through which that money would be forced to be invested in Canada. Furthermore, the same firm reportedly seeks (read lobbying) from the federal government an infusion of $10 billion for the new fund.

As a Liberal and a potential party leader, given Justin Trudeau’s fortunes, Mark Carney could become prime minister in the immediate future. This means that Carney would benefit from creating new rules forcing investment money to stay in the country in two ways: As a leading man at Brookfield, Carney and the firm stand to make tens of millions from the policy. Second, as a carbon tax enthusiast, once squarely in political office, Carney would benefit from masking the ill, underproductive effects of the radical green agenda and carbon taxes he supports.

When Alberta progressives oppose the desire of many Albertans to patriate Alberta pension funds to the province, they cite concerns that the province might use the funds for political purposes, undermining the maximum return. This is not an outlandish concern, in some respects, given the history of the Alberta Heritage Fund.

However, it is not an exclusive danger inherent to the Alberta government. It does not warrant the presupposition that the federal government is a better steward of Alberta’s pension wealth, as demonstrated by the developments above. All things being equal, and unless human nature is outlawed by federal statute, the risks are the same.

But if something goes wrong with Albertans' pension wealth, would they rather deal with people in Alberta than people in Ottawa, half a continent away? Raising Alberta voices in Ottawa when Ottawa has been bent on doing the opposite of what is good for Albertans has never produced good results or reversed the nefarious effects on Albertans.

Ottawa politicians will do what is best for Laurentians every single time. The history of the Dominion, from the national policy to Crow rates and the National Energy Policy to Carbon Taxes, shows Ottawa policies always favour vote-rich Laurentia first and foremost.

Mark Carney's product development for Brookfield shows, at worst, that Alberta's pension wealth is just as much as risk with federal policies driven by political motivations. This one would be doubly bad because it is meant to serve and benefit Carney and his Bay Street friends as much as it is designed to help his future colleagues in Ottawa. And on both counts, Carney would benefit as a financier and politician.

Albertans should take their money and run.